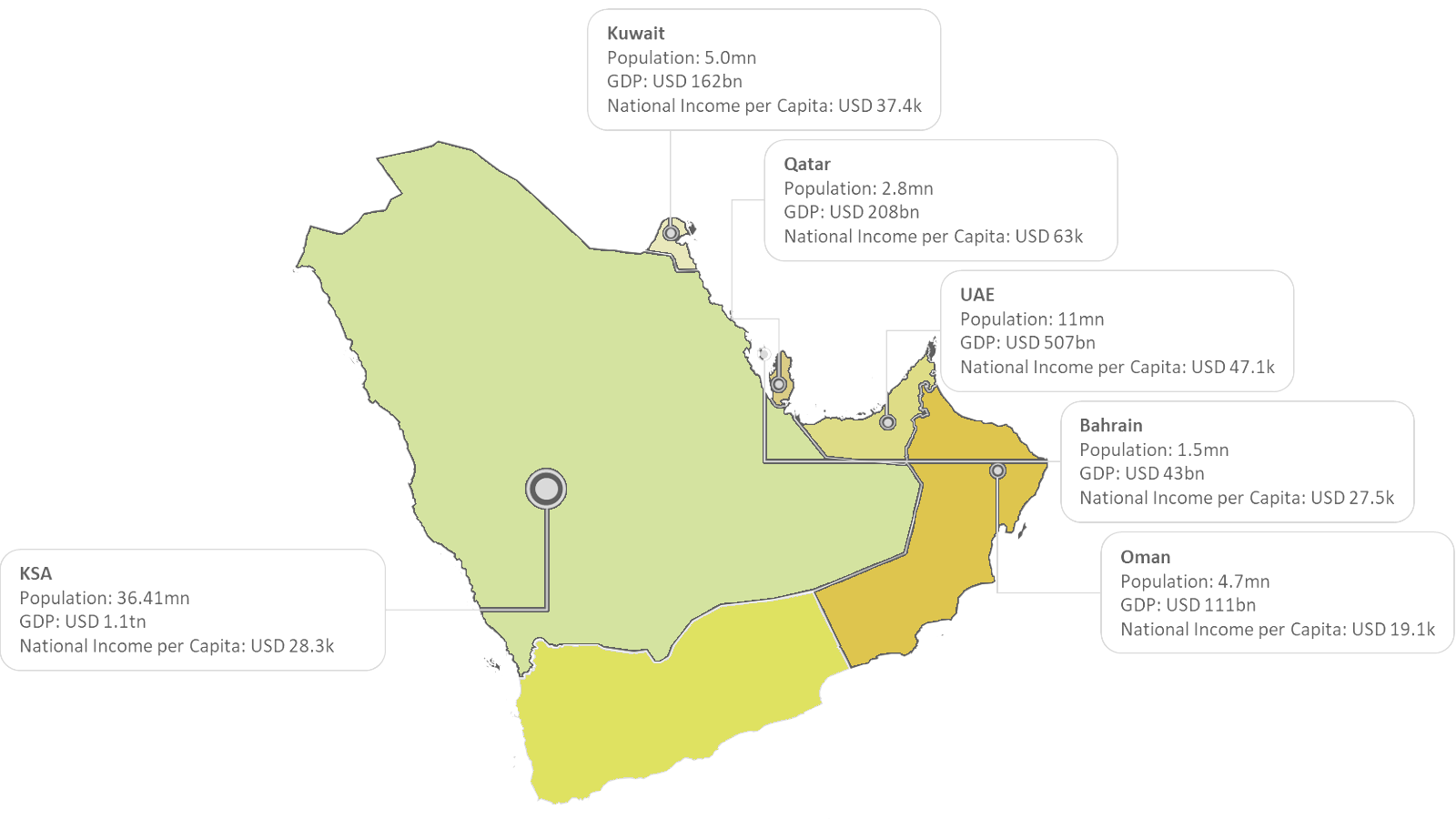

Due Diligence, Financial Modeling, IC-Ready Materials & Fractional Leadership — Built For The Gulf

We help investors decide quickly and help non-GCC companies enter the region with confidence: rigorous commercial/ops & tech/AI diligence, bullet-proof models, forwardable IC packs, and fractional C-suite + in-country representation that convert interest into signed deals.

What You’ll Receive

- Findings memo with decision gates (R/A/G)

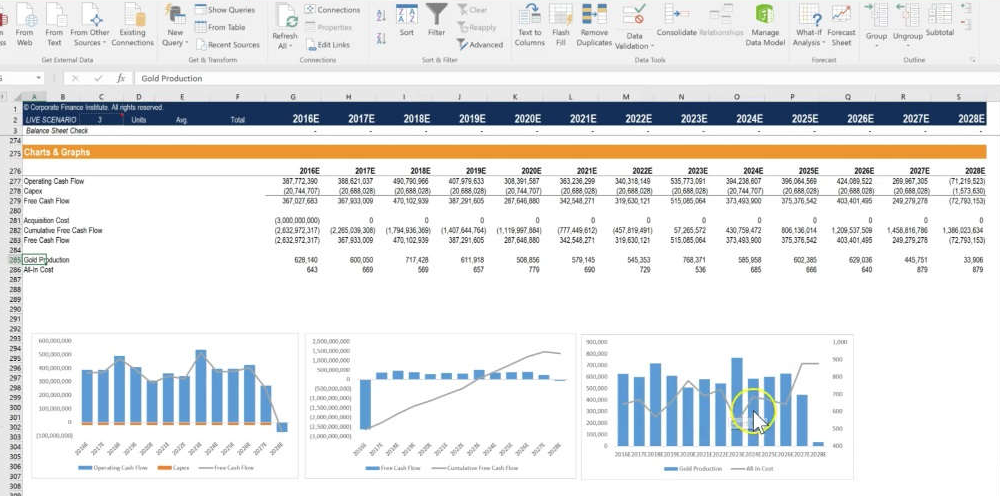

- Live three-statement model with scenarios & sensitivities

- IC one-pager + 10-slide board-ready deck

- Customer/partner reference dossier

- Governance note: data residency, logging, rollback

- Data-room index + “what changed this week” log

- Optional: Fractional CSO/CIO/CRO + regional representation